By Rob Kay, Senior Partner, Blevins Franks

The French government published its 2023 projet de loi de finances on 26 September. This now has to pass through the usual parliamentary process before being finalised and approved at the end of the year.

Unsurprisingly, the budget’s main purpose is to help protect households and businesses from inflation. During the press conference, Finance Minister Bruno Le Maire said that “no new spending” will be approved unless it has “been budgeted to the nearest euro”. He added that the economy was “holding up”, but the state’s absolute priority was to bring down inflationary pressures.

The finance bill therefore includes a €45 billion package to help households and companies with energy prices increases, including capping gas and electricity bills at 15% in early 2023.

2023 taxation

Considering the current local and international economic context, this budget does not carry any significant reform. Income tax bands will increase – thereby reducing tax liabilities – and there are no tax rises.

Income tax

The income tax bands will increase by 5.4%, to match inflation.

The income tax rate bands and scale rates for 2022 income are:

Up to €10,777 – nil

€10,778 to €27,748 – 11%

€27,749 to €78,570 – 30%

€78,570 to €168,994 – 41%

Over €168,994 – 45%

This means that employees who received a pay rise because of inflation are much less likely to be hit by a higher tax rate. Those whose income has not changed will now benefit by paying less tax on it.

Note that these new tax brackets apply to your 2022 income (as declared in the tax return you submit in spring 2023).

The budget also facilitates the lowering of income tax withholding at source if the taxpayer’s income decreases, as well as simplifying the collection of taxes for foreign employers who have employees who are French tax residents and regularly work from home.

Taxe d’habitation and TV licence reform

The taxe d’habitation reform which began a few years ago reaches its conclusion in 2023, with the complete suppression for the remaining 20% of households who were still paying it.

This budget also confirms the removal of the TV licence (contribution a l’audiovisuel public) implemented in the August 2022 revised budget.

Succession taxes reform

During his presidential campaign, Emmanuel Macron promised to reform and diminish succession taxes by increasing the tax-free deduction for inheritances between parents and children from €100,000 to €150,000, and by lowering the taxes for other relatives such as stepchildren.

However, given the current economic context, the government does not support this reform at the present time. It could still be voted on by Parliament further to a MP amendment, but this is uncertain.

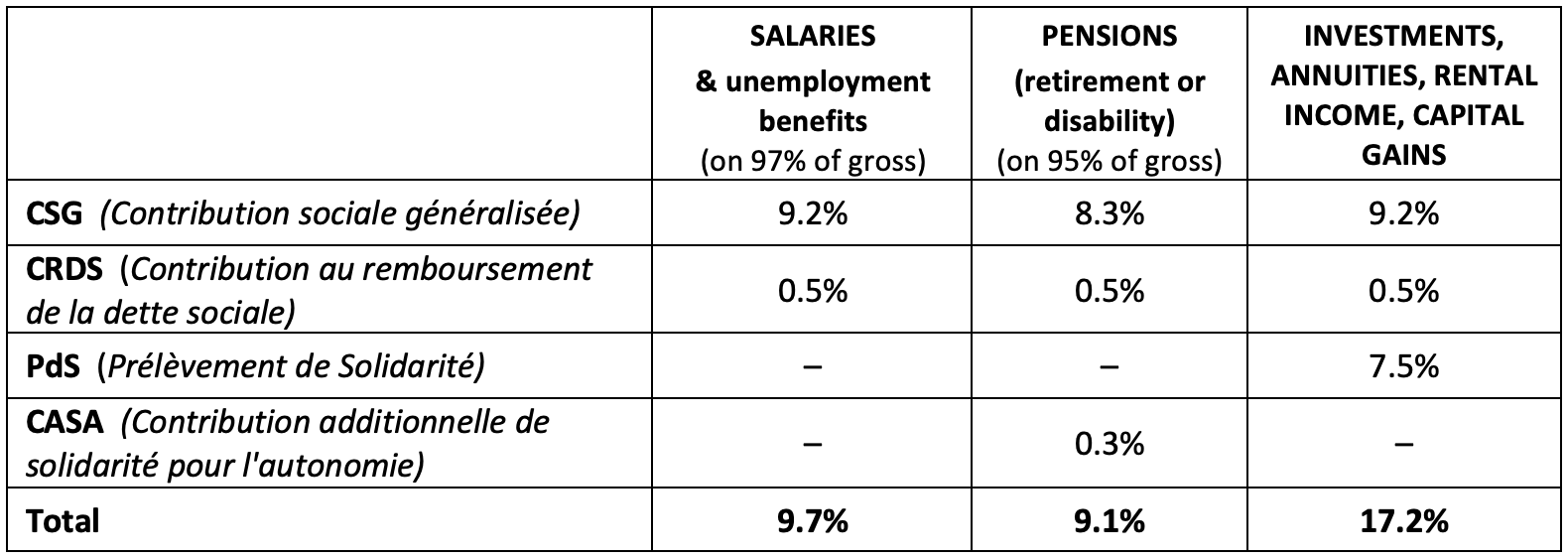

Social charges

The budget maintains social charges at the same rates as 2022:

Employment income – 9.7%

Pension income – 9.1%

Investment income – 17.2%

The special lower rates also remain in place:

Pensions – Social charges on pensions are reduced to 7.4% for those whose taxable income is less than approximately €2,000 a month (€3,000 for a couple). If you have Form S1, and/or are not subject to the French health care system, you do not need to pay any social charges your pension income, regardless of the amount you receive.

Investment income – If you are covered under the health care system of another EU/EEA country, or if you have Form S1, social charges are reduced from 17.2% to 7.5% for investment and property income. Earlier this year the French government confirmed this continues to apply to UK residents and to UK nationals living in France.

Real estate wealth tax (IFI)

The current threshold of €1,300,000 will stay in place for 2023 and no changes are proposed to the scale rates of wealth tax.

Assurance-vie

The budget does not include any changes to the taxation of Assurance-vie policies.

The savings and investment ‘wrappers’ remain very attractive from both a tax and succession planning point of view.

The finance bill is now being debated by parliament and will be approved by the end of the year. There may be changes as it goes through the process.

Please do not hesitate to get it in touch with our advisers if you need any clarification or feel it is time to review your tax planning to ensure it is up to date and as effective as it could be.

Tax rates, scope and reliefs may change. Any statements concerning taxation are based upon our understanding of current taxation laws and practices which are subject to change. Tax information has been summarised; individuals should seek personalised advice.

Blevins Franks Group is represented in France by the following companies: Blevins Franks Wealth Management Limited (BFWML) and Blevins Franks France SASU (BFF). BFWML is authorised and regulated by the Malta Financial Services Authority, registered number C 92917. Authorised to conduct investment services under the Investment Services Act and authorised to carry out insurance intermediary activities under the Insurance Distribution Act. Where advice is provided outside of Malta via the Insurance Distribution Directive or the Markets in Financial Instruments Directive II, the applicable regulatory system differs in some respects from that of Malta. BFWML also provides taxation advice; its tax advisers are fully qualified tax specialists. Blevins Franks France SASU (BFF), is registered with ORIAS, registered number 07 027 475, and authorised as ‘Conseil en Investissements Financiers’ and ‘Courtiers d’Assurance’ Category B (register can be consulted on www.orias.fr). Member of ANACOFI-CIF. BFF’s registered office: 1 rue Pablo Neruda, 33140 Villenave d’Ornon – RCS BX 498 800 465 APE 6622Z. Garantie Financière et Assurance de Responsabilité Civile Professionnelle conformes aux articles L 541-3 du Code Monétaire et Financier and L512-6 and 512-7 du Code des Assurances (assureur MMA). Blevins Franks Trustees Limited is authorised and regulated by the Malta Financial Services Authority for the administration of retirement schemes. This promotion has been approved and issued by BFWML.

You can find other financial advisory articles by visiting our website here