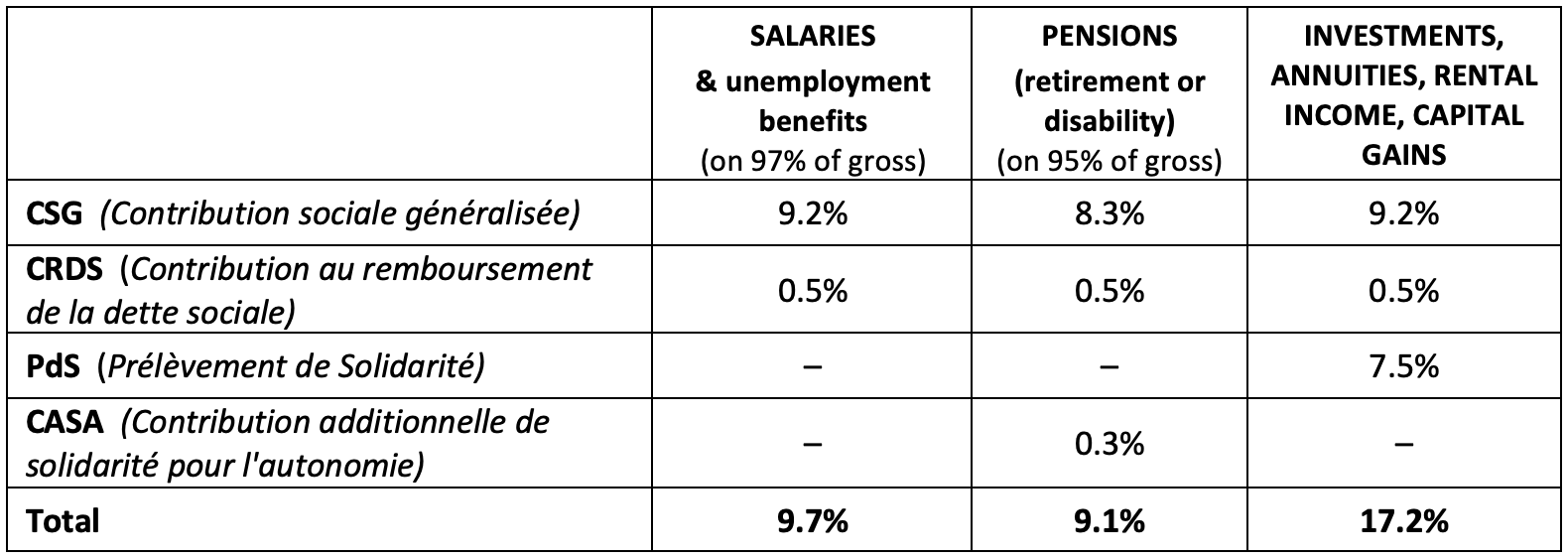

Are UK pensions liable to social charges?

Social charges on pension income are only payable if you are subject to the French health care system (you are either paying cotisations sociales or PUMA contributions). If you are not, and/or you have Form S1, you escape social charges on pension income as well as on pension lump sums on the basis that you the UK pays for your healthcare in France.

Otherwise, if your pension income is less than €2,000 per month (€3,000 for a couple), you will pay 7.4% instead of 9.7%.

Reduced 7.5% rate for property and investment income

Since 2019, individuals covered under the health care system of another EU or EEA country are no longer subject to the CSG or CRDS charges on their investment income or capital gains. This means only just pay the Prélèvement de Solidarité at 7.5% - a tax saving of 9.7%.

Last year, the authorities took the view that UK residents or individuals holding Form S1 no longer benefited from this reduction since, as a non-EU state, the UK is no longer subject to its social security laws. This year, however, they reanalysed the Brexit Withdrawal Agreement and the law on social charges and came to a more favourable interpretation – and officially confirmed that UK nationals continue to be exempt from CSG & CRDS social charges on investment income. This is backdated to 1 January 2021, so those who paid the full rate last year can claim a refund.

You can therefore benefit from this 7.5% social charges rate on investment income if you meet these conditions:

· You live in France and hold Form S1 and/or are covered by the health system of another EU or EEA country or affiliated to the UK social security system; or

· You are a UK resident (or reside in an EU/EEA country outside France) and earn French source income or gains (eg, from a French property).

If you are eligible, this 7.5% social charges rate applies to:

· Capital gains made on the sale of property

· Rental income

· Investment income – interest, dividends, capital gains made on the disposal of securities like shares, withdrawals from assurance-vie etc.

Note that the 30% flat tax charged on investment income since January 2018 – the Prélèvement Forfaitaire Unique (PFU) – already includes social charges at the standard rate of 17.2%. Therefore, if you qualify for the reduced rate, you will pay 20.3% in total.

How are social charges paid?

Social charges are paid in arrears and usually calculated on the income declared in your income tax return. Each autumn you receive a notification of the amount you owe for the previous year’s income.

For certain types of income/gain (assurance-vie under special rates, real estate capital gains, dividend/interest advance payment etc.), the charges are paid by the 15th of the following month.

Tax planning

When you add social charges to income tax, French taxation can be rather daunting. In any case, with French tax regime being so complex, and frequently changing, it is always a good idea to take personalised advice to ensure you are following the rules correctly.

A locally based tax and wealth management adviser can guide you through the local tax regime and advise you on the compliant tax planning opportunities that are available in France, particularly for your investment capital and pensions.

The tax rates, scope and reliefs may change. Any statements concerning taxation are based upon our understanding of current taxation laws and practices which are subject to change. Tax information has been summarised; an individual is advised to seek personalised advice.

Blevins Franks Group is represented in France by the following companies: Blevins Franks Wealth Management Limited (BFWML) and Blevins Franks France SASU (BFF). BFWML is authorised and regulated by the Malta Financial Services Authority, registered number C 92917. Authorised to conduct investment services under the Investment Services Act and authorised to carry out insurance intermediary activities under the Insurance Distribution Act. Where advice is provided outside of Malta via the Insurance Distribution Directive or the Markets in Financial Instruments Directive II, the applicable regulatory system differs in some respects from that of Malta. BFWML also provides taxation advice; its tax advisers are fully qualified tax specialists. Blevins Franks France SASU (BFF), is registered with ORIAS, registered number 07 027 475, and authorised as ‘Conseil en Investissements Financiers’ and ‘Courtiers d’Assurance’ Category B (register can be consulted on www.orias.fr). Member of ANACOFI-CIF. BFF’s registered office: 1 rue Pablo Neruda, 33140 Villenave d’Ornon – RCS BX 498 800 465 APE 6622Z. Garantie Financière et Assurance de Responsabilité Civile Professionnelle conformes aux articles L 541-3 du Code Monétaire et Financier and L512-6 and 512-7 du Code des Assurances (assureur MMA). Blevins Franks Trustees Limited is authorised and regulated by the Malta Financial Services Authority for the administration of retirement schemes. This promotion has been approved and issued by BFWML.

You can find other financial advisory articles by visiting our website here